Wealth is something everyone would want to pursue. Simple living is choice not a constraint and if you opt to it, it could help to grow your wealth and retain it.

From Warren Buffet, Mark Zuckerburg to Azim Premji many billionaires are example of simple and frugal living.

World economy is volatile and irrespective of your professional position and earnings it may adversely impact you at any point.

With simple habits in early life can help to flourish the later part of life and could help future generations.

Simple living people focus on saving money first before spending. They plan to save minimum fix amount of regular income and spend rest for luxury/pleasure.

At any given time debt is not good. It may create your credit record but it is wise to avoid EMI for every other item you purchase.

Don't by 50" LED on EMI/APR if you could settle with 32" without any debt.

Majority of people are under credit card debt.

Rich people look for building assets and not liabilities. Assets that would yield them money to buy more assets.

Bigger house, more cars, fancy crockery, expensive gadgets etc.

If wealth building is goal then don't waste money on spending things that would need more money to retain, like a bigger house costs bigger maintenance cost in electricity bills, water bills, taxes cleaning etc.

If you have family car for daily routine and you want to have SUV for your weekend trips, when you buy that second big SUV you start paying for insurance, oil and maintenance, road taxes for the car which is parked often.

You can rent out that fancy car for weekend trip than spending lot of money on it and adding one more liability.

You have to take time to start learning about money, yes it is the most important process in making money. No matter of your profession you could be a good doctor, clever engineer but knowledge about finances and money can help you to grow.Otherwise we have read news of movie stars getting bankrupt.

From Warren Buffet, Mark Zuckerburg to Azim Premji many billionaires are example of simple and frugal living.

World economy is volatile and irrespective of your professional position and earnings it may adversely impact you at any point.

With simple habits in early life can help to flourish the later part of life and could help future generations.

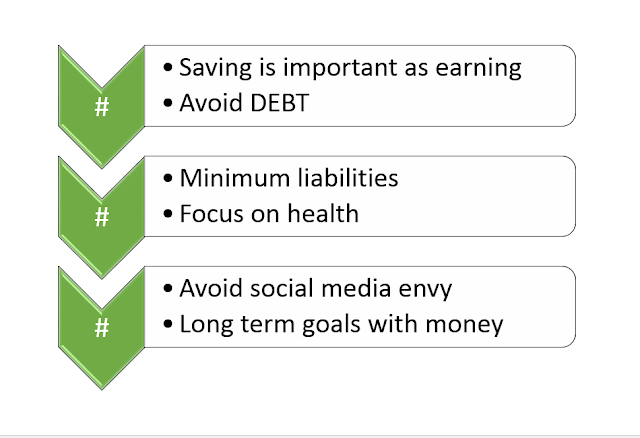

# Saving is important as earning:

Simple living people focus on saving money first before spending. They plan to save minimum fix amount of regular income and spend rest for luxury/pleasure.

# Avoid DEBT:

At any given time debt is not good. It may create your credit record but it is wise to avoid EMI for every other item you purchase.

Don't by 50" LED on EMI/APR if you could settle with 32" without any debt.

Majority of people are under credit card debt.

“Poor people have a big TV. Rich people have a big library.”

Jim Rohn

# Minimum liabilities:

Rich people look for building assets and not liabilities. Assets that would yield them money to buy more assets.

Bigger house, more cars, fancy crockery, expensive gadgets etc.

If wealth building is goal then don't waste money on spending things that would need more money to retain, like a bigger house costs bigger maintenance cost in electricity bills, water bills, taxes cleaning etc.

If you have family car for daily routine and you want to have SUV for your weekend trips, when you buy that second big SUV you start paying for insurance, oil and maintenance, road taxes for the car which is parked often.

You can rent out that fancy car for weekend trip than spending lot of money on it and adding one more liability.

# Focus on health:

Simple living people more often have healthy habits, it is not really important to party every weekend. Simple living people like to spend time with friends and family that doe not involve many of partying expenses.

Healthy eating, avoid excessive alcohol and junk food. Simple living people more often chose simple foods that help them retain good health.

# Avoid social media envy:

Facebook, Instagram and what not; social media have record of almost every individual on the world. Overspending time on social media could lead to envy.

Take time to read books, and spend time wisely.

# Long term goals with money:

You have to take time to start learning about money, yes it is the most important process in making money. No matter of your profession you could be a good doctor, clever engineer but knowledge about finances and money can help you to grow.Otherwise we have read news of movie stars getting bankrupt.

If you can sit in the shade of tree today, because someone planted it in past. Same way to have money in later life or for your children, invest for long term.

Start immediately

Start only BIG

Bring in Excitement

You have infinite potential- No Beginning, No end

You cannot give what you haven’t got

Earning money is the simplest thing in the world

Become aware of what you don’t have, what you don’t see

Use the information you learn

Intellect dictates your emotional experiences

Everything is, as it is

Avoid that which weakens you

Advance your consciousness, the most important thing

you can do is release the things that hold you back

You must build a unique identity and constantly reinforce it!

~ Unknown

References-

https://addicted2success.com/quotes/quotes-by-millionaires/

http://www.istorybox.com/?#5tips